After the recent lost case for collusion, I don’t see the industry taking seriously what is happening.

Social media, statements, and emails I have seen from the industry are in defensive mode. There is all-out campaign to pump up the industry. A campaign to tell the industry’s story and convince the public that they are wrong and simply don’t understand.

This won’t help or change the fact that the public has lost trust in the industry. Blaming them for it, talking down to them, and pumping ourselves up and refusing to change isn’t going to help to regain it.

We have to listen to the public, understand their concerns, empathize, and find new ways to address their concerns and needs.

Just saying you know how things are done, and know better isn’t going to help in the conversation when one is telling you they don’t like how things are done and want change.

This is the opportunity to reflect, discuss, and work with the public to implement change that they obviously want. You don’t win arguments calling the other side wrong about how they feel, call them clueless, use fear, and say trust us.

You win the argument by listening, understanding the other side, addressing their concerns, innovating, and changing.

I am here to say I am listening. Tell me what you think, what you don’t like or like, what you want, how to do better for you, and how to make home selling and buying easier, better, and cheaper.

#marylandrealestate #nar #realestateindustry #homebuying #homesales #dmvrealestate #dcrealestate

Ask not what you will do for your realtor but what your realtor will do for you!

Treasury Auctions aren’t as pretty as they used to be!

As the Treasury pushes more and more debt and more and more debt at the longer end things aren’t as business as usual. October issuances have had dealers required to absorb more of the total sales higher than the usual share of around 10 to 12%, as an increasing number of potential buyers hesitated to participate. This development in auctions is happening in the 20Y, 10Y, and 3Y bonds and notes.

In a note released on Thursday, strategists from TD Securities raised a pressing question, pondering whether this might be a “canary in the coal mine.” since “While purchases by end-users during auctions have remained robust in recent years, the recent decline in end-user demand is causing concern, particularly given the limited balance sheet capacity of dealers to support these auctions,” they noted.

Treasury issuances, Fed’s QT, and Japanese/Chinese absence have pushed the selloff in long-dated Treasurys and bear steepening. Things are not great but not in disaster mode in the Treasury auctions. Yields are rising across the board. The yield curve is flattening but flattening without the short end falling with the 10Y hitting briefly 4.996%, the 20Y hitting 5.33%, the 30Y hitting 5.1%, and the 2Y hitting 5.25%.

Across the Pacific, things aren’t better with the Japanese 10Y hitting .85% not since in a decade. The risk of Japan abandoning YCC, selling off Treasuries, intervening in the yen, and blowing up the yen carry trade is growing.

With all this going on and Powell saying again inflation is too high and GDP growth too strong, the stock market has barely moved. The amount of this time is different sentiment is astonishing. My favorite phrase from Powell today was “We’re very far from the effective lower bound, and the economy is handling it just fine,”. This epitomizes the late-stage return to normal.

We know the economy is not going to keel over this year. It might not even keel over the first half of next year but it will sooner or later with rates going even higher for even longer. That has been the historical behavior of the economy without exception and has been with much less debt, much less government spending, less or as much geopolitical and structural issues, and much lower P/E and equity valuations.

How long before Japanese bonds blow up like US treasuries?

How long before Japanese bonds blow up like US treasuries?

Not sure how the BoJ and MoF can hold back the tsunami. US 10y is going over 5% soon and will weaken the yen past the 150 magic wall. Not like their inflation is getting better (flat around 3.2% for months).

A few months ago I said to watch out if we blow past 1% for the JP10Y and YCC goes out the window. This would be the biggest shift in monetary policy. Should this happen, it could have significant implications for financial markets. This could halt the depreciation of the yen and blow up the yen carry trade that many in the US were using to buy US assets, blow up short positions against the yen, and suck liquidity from fixed-income markets in other countries. Also, this could impact US treasuries big time if they sell US treasuries. Late last year when they sold Treasuries, TIPS and 10Y yields were pushed higher and along with a more hawkish Fed tone, we also saw equities fall. Yes, Japan can influence US stocks and bonds.

Japan is not just another country. It is a major financial player and was with China, the ones that bailed us out in 2008. This is the scary part. Congress is not going to stop spending we know that. Without Japan and China playing ball and releasing some of the pressure on the US, I cannot see how we can have lower rates.

A global hard landing is becoming the base case scenario and probably the preferred scenario.

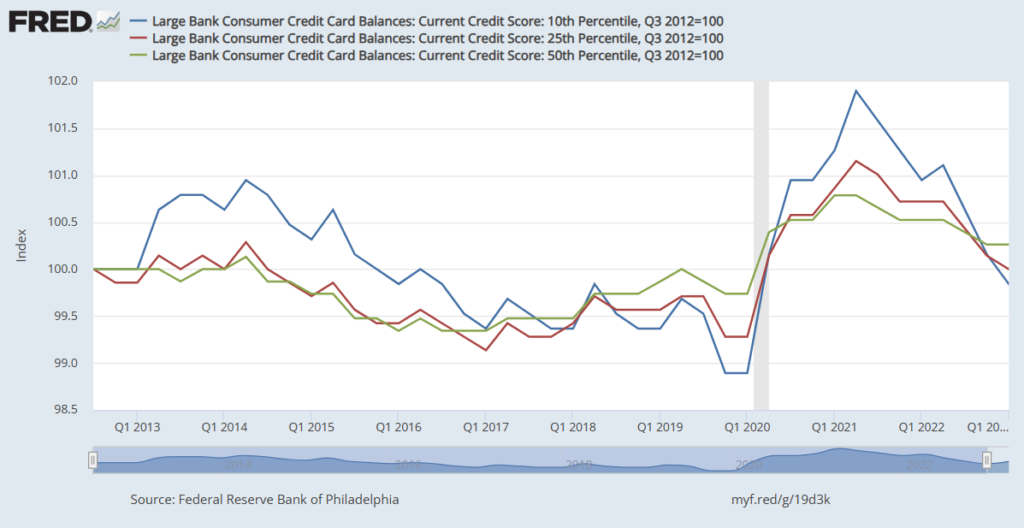

RE industry: “We don’t have the same issues as before GFC because of higher standards and credit scores!”

Me the last 3 years: “You sure about that?”

I said several times that the stimulus and forbearance programs were acting as temporary financial safety nets and worse a trampoline for people to borrow more money than they could just like the pre-GFC.

Thanks to Uncle Sam, credit scores shot up like a SpaceX rocket in 2020 and 2021. But, alas, just when you thought the party would never end, the music stopped, and credit card delinquencies decided to crash the party at the end of 2021 and through 2023.

More and more research is coming out looking at the impact of gov intervention on credit scores during the pandemic. When I was saying rising scores with 8 million homeowners in forbearance, millions not paying rent or college debt, and no one getting reported would lead to artificially opening credit and making underwriting mistakes no one listened.

Now we are starting to see that the ones that got the biggest boosts in credit score (deep and subprime) are the ones getting more and more behind in payments. Surprise!

Like Cinderella’s carriage turning back into a pumpkin, their scores are returning to pre-COVID levels. But wait. They got to borrow like a princess to buy the glass slippers from Amazon, the carriage at 120% LTV, and a castle 50k over asking. The banks swore to us they were not lending to subprime like pre-GFC. Yes technically, because much of subprime was magically turned into near and prime with a twist of the wand from the fairy grand federal government mother and got an allowance to build their savings now pretty much gone.

The truth is the banks didn’t care as they had bloated deposits, investors, and the Fed eating up any asset they would through their way. All one had to do was make a loan and securitize it and it would be bought at a premium as soon as it was originated. Sound familiar?

It’s the same story every time. If there is a buck to be made someone will look over details and close their eyes. No one stopped for a second and asked if credit scores, credit history, DTI, savings, and service payments as a percentage of disposable were affected by external forces and no longer were accurate, if long-term/temporary effects, or if standards adjusted to reflect the changes. Nope, let’s lend and lend a low rates and hand out even bigger loans.

They said this time is different. Yes, this time the pig had lipstick on it.

Some of the recent data coming out:

Why can’t we have a soft landing or lower rates?

Milton Friedman said to watch government spending! Boy, was he right. The government is spending like we are in a recession and little of it is hitting the real economy. Just look at the deficit, interest expense, and the reverse repo market keeling over.

When the reverse repo market experiences a drain, this typically significantly decreases the amount of cash available in the market. The government is draining it with all its deficit spending and will get worse as revenues start falling and interest payments rise. Simply put the Us government is draining excess cash in the system to fund unsustainable spending and when it runs out it will start draining money from the real economy and significantly curb growth.

A drain in the reverse repo market means there is a reduction in the supply of cash available in the market and can put upward pressure on rates. This is happening as the Fed is doing 75B a month of QT. Banks are on the receiving end of all that is wrong with the economy.

Banks, pension funds, and insurance companies are bloated with treasuries and MBS that have been crushed and forced to hold to maturity. Banks are also seeing continued deposit flights, higher costs, and capital requirements. You don’t want to be a bank today.

A significant drain in the reverse repo market can lead to market disturbances and disruptions. It can affect the functioning of the money market and short-term funding markets, potentially causing volatility and instability in financial markets.

If the drain continues at the current rate, reverse repo will be fully drained within 6 to 8 months. Then what? Is the government going to stop spending 25% of GDP? Will they stop running deficits at 6 to 7% of GDP? Very implausible during an election year. Hiccups, shutdowns, minor cuts of a few billion here or there sure but nothing big enough to move the needle.

So where is the money going to come from? I don’t know and neither does the Fed nor the government. Can they do QE? Sure but has that helped us hold the debt growth? So not sure that the Fed can do QE or banks that just got burned buying low-yield treasuries are going to risk getting fooled a second time and if they do QE then forget about fighting inflation.

There is a real risk we could be facing higher yields not just for longer but “even higher for even longer” and in the middle of a liquidity crisis that the Fed could do little about. Treasury might roll out in-force on and off-the-run operations, BTFP could explode, and more banks could go bankrupt while rates stay high.

So if pundits start saying “even higher for even longer” you know you heard it. 6%+10y is not out of the question.

Oh, and I am not even including the possibility of the BoJ abandoning YCC and sparking a crisis in markets. The soft landing narrative is becoming more plausibly implausible while a new higher rate regime is getting more plausibly plausible.

Why can’t we have a soft landing?

Why can’t we have a soft landing?

Powell has taken back his message of a soft landing and rightfully so. While we are not yet close to a recession there are signs that we are not that far away. Now the question should be, can we have a hard landing and get lower rates?

That is a major question on my mind and I am not sure that in the event of a hard landing, we could get lower rates right away.

In my previous post, I said “1-6 [speaking of conditions for lower rates] are not aligned with the stars even under cloudy skies. Making claims that low rates are just right around the corner is plausibly implausible in the short term”.

Check out below the signs of cracks in the economy that I am seeing and why we might not see lower rates immediately following the start of a recession.

The soft landing narrative is becoming more plausibly implausible!

Why can’t we have lower rates?

Why can’t we have low rates?

I see real estate agents and loan officers on social media claiming low rates are just around the corner for the last 12 months. Why do they keep getting it wrong?

Well, first off they are in sales. No one in sales tells you this is a bad time to buy and they will always find a response to an objection or concern. Second, they are in sales and don’t have a good understanding of what economic conditions are needed to have lower rates. So what are these conditions that are needed to have a low-rate environment?

1. You need low inflation and we don’t have it. Inflation has broken out again in the last two months and will be back to 4%+ by the end of the year at the current rate. No self-respecting investor would accept low rates in a higher inflation environment. Basic economics.

2. More liquidity and we don’t have that either. The Fed is shrinking the balance sheet sucking out the money supply.

3. Bank strength. Well, we are 0-3 now, as banks are still seeing deposits falling, AOCI losses, rising defaults, higher capital requirements, holding low yield loans and assets, rising costs, higher insurance fees from FDIC, and higher deposit rates all while the Fed took away their bread and milk speculating on QE. What bank would hand out negative rates in that environment?

4. Low demand for borrowing. This one is tricky because it is counterintuitive and has to do with rate fallacy. As demand for borrowing rises so do rates. With more people asking for money, the banks can become choosy and increase rates. Borrowing like all other assets and commodities is bound by the laws of supply and demand. So far borrowing demand has slowed but not fallen. Consumers are racking up credit card debts and corporate issuance is still rising.

Now the 10y has its own problems with the current and growing issuance of maturing government debt and deficit spending. As the gov continues to spend and roll over debt they are slowly inundating the market with debt (high demand for borrowing). This in turn sucks out liquidity and crowds out others that also want to borrow raising rates.

5. Low Risk and low uncertainty. Self self-explanatory and no one can argue we have either.

6. Credit loosening. Well if (1) is reducing your ability to have money to lend and cutting off your speculative action, (3) is weakening your balance sheet, (4) high demand gives you an opportunity to raise rates, and (5) your risk is higher then tightening standards and being picky makes sense.

1-6 are not aligned with the stars even under cloudy skies. Making claims that low rates are just right around the corner is plausibly implausible in the short term but everything is transitory so one day they will be right.

Is another debt bubble ready to burst?

We have to add one more debt crisis, that few talk about, and add it to the troubles in CRE, auto ABS, zombie debt, hold-to-maturity Treasuries/MBS, and personal loans.

The one we have to add to the long list had a chance to be saved until the Supreme Court decided to axe the rescue package. If you are wondering what I am talking about, I will give you a clue. It’s a 1.7 trillion debt that affects millions of Americans and more investors than you think.

I am talking about student debt and the Supreme Court just ruled against the Biden administration’s claimed authority to cancel or reduce student loan debt. The plan was to forgive $400 billion, which would have canceled up to $20,000 in federal student loans for 43 million Americans. What they forgot to tell you is that it was also a bailout for investors and banks that loaded up on SLABS in the last decade.

What are SLABS? They are the MBS of student loans aka Student Loan Asset Backed Securities. Yes, student debts have been securitized and sold to banks and investors like everything else we securitize and sell for profit.

Private and federally insured student loans like MBS are bundled, rated, and sold in tranches to institutional investors as bonds. SLABS are non-collateralized (but some are government-guaranteed) student loan debt. Think of them like MBS with some with government guarantees and some not guaranteed bundling prime and subprime borrowers together with a shady rating system reminiscent of the subprime CDO mortgage market pre-GFC but 0 with collateral aka no house to foreclose.

They are sold as low-risk securities to investors with high yields that are rising. Sounds great for investors but the problem is that the delinquency rate is rising and is already back to pre-pandemic levels when we were already talking about a crisis and a potential 20 to 40% of borrowers unable to pay.

The Biden administration might have wanted to bail out students but unseen to the public it would have also bailed out investors too. Now that’s dead thanks to the Supreme Court. The chances of Congress doing anything about it before 2025 are slim to none and even after the chances are small to slim. So what happens next?

Defaults will continue to rise. Unlike other debts like a mortgage, it’s nearly impossible to escape it. You can’t declare bankruptcy and walk away from the debt as the future earnings of borrowers are the collateral. The government will come in and force payments by using future tax returns and wage garnishing.

This might be the straw that breaks the camel’s back as no one can walk away from that debt. Some might have to give up their cars and homes to pay for the debt that has been sold to investors and banks that are loaded up on 1.5T of bundled-up prime and subprime loans.

It’s a mess 20 years in the making like everything else.

The stock market is up. Yields on bonds are up. So what happens to real estate?

2M+ home sales are up 25% yoy and are back near 2021 highs. Home sales under 800k are down 20 to 45% (mid-tier homes hit the hardest) and home sales between 800k and 1M are flat to slightly negative. Even worse the share of luxury home sales versus total sales has risen after falling in the second half of 2022. It is now even greater than in 2021 as demand at the middle and bottom has been crushed by high rates and upper-class home sales are flat.

Simply put we are selling fewer homes but more luxury homes as the top is still being courted by banks for their wealth management business and borrowing at lower rates. Instead of First Republic Bank doing 58B in interest-only mortgages, it’s JPM. It’s good to be the king.

We have a national real estate market that is correlated to market movements. Been the case since early 2000. The market goes up and more luxury homes are sold just like private jets, yachts, and exotic cars. The market falls and those goods fall. Homes are no longer shelter or assets but goods.

The wealthy do well they sell and buy homes while the middle class either can’t buy due to high rates or can’t sell and buy due to high rates.

We have a dysfunctional economy. Demand is being propped up by 10% of households and the bottom 90% is struggling. The economy will not go into recession yet nor will it beat inflation.

The Fed will hike next week and the markets will shrug it off as the last one. September after getting 2 more inflation reads that will show inflation picking up again (end of base effect, July 2022 read 0%, more spending by the top, dollar falling, and commodity prices rising) and the Fed will raise again.

We could solve a lot of problems with higher taxes on the top 10% versus raising the cost of living on everyone else that doesn’t own 90% of the stocks or bonds.

We could be waiting for Godot for the cumulative effect of rate hikes to crush demand from the bottom as the top keeps buying with their dividend payments and stock rallies.

If we do decide to wait for Godot we might just find out he is bringing a lot of picketing friends demanding raises and we can all dine together at a restaurant with a stagflation fee of 15%.

You the clients and future clients, don’t have to accept it. You don’t have to accept the commission they are offering or the level of services they barely talk about. You have the right to negotiate with real estate agents and their brokers the level of compensation and services as a seller and as a buyer. You deserve more it’s your money, your home, you have the power. You don’t have to:

– Pay broker fees!

– Pay administrative or hidden fees!

– Pay what they say is the commission rate as a seller and a buyer and can negotiate!

– Accept long commitments and have the right to say how and when you can terminate the contract!

– Accept little services and customer service.

– Take on all expenses.

– Accept a few pictures, post them on the MLS, and do an open house and have someone else than them doing it!

You don’t have to accept any of it!

You are the client, you own the home or have the purchasing power, not realtors. You own the power, the asset, the purse, and the process not realtors. You decide not us. You always had the right to set the terms and not set terms set on you. You always had the right to negotiate not be bound by industry standards or policies.

NAR, real estate commissions, and large brokerage house have lost their case in court and have been found to be colluding. Jurors have found that they colluded and awarded 1.78B in damages. We have known this for a long time in the industry and have been saying it. The system was built not as a service-based industry that prides itself on representing the interests of clients but on a middle-man pyramid scheme industry where the few that are on top collect splits, commissions, and fees.

It is time to take back the industry and bring back the clients and the public back into focus, ethics, services, and value. The time is now.

Like JFK said, “I would rather be accused of breaking precedence than breaking my promises.”

My oath is to my clients, their interests, and their success not that of NAR, real estate commissions, large brokerage houses, and developers. My promises are for the first not the latter.

#silversrpingmd #homebuying #homebuyingtips #realestate #dmvrealestate #dmvrealtor #dmvevents #washingtondc #rockvillemd #washingtondc #marylandrealestate #firsttimebuyer #firsttimehomeowner #buyingahome #realestatedata #realestatetips #realestateadvice