The industry is convinced that if only interest falls pent-up sidelined demand would be unleashed. But since mortgage rates started to fall in October from 8% to 6.85% today, mortgage applications have also fallen on an unadjusted basis except for one week. Today the Mortgage Bankers Association reported that the seasonally adjusted Purchase Index decreased 1% while the unadjusted Purchase Index decreased 4% compared with the previous week. Mortgage applications are 18% lower than last year and down to mid-1990 levels.

So why is demand falling when rates are falling?

• Prices are high: even if the rates have come down they aren’t low enough yet to make a dent in affordability. The largest pool of homebuyers is home sellers who sell and turn around and buy a new home. With 60% of mortgage account holders sitting on 4% of lower fixed rates, those homeowners are effectively trapped in their homes. They cannot sell and retain the same mortgage payments. Without sellers, the market will have low supply but also low demand.

• Savings: Even if rates come down homebuyers still have to come up with a downpayment and closing costs. In 2020-2021, the personal savings rate shot up to new records thanks to stimulus checks and forced savings from working from home. Today that savings rate has fallen to 2008 levels. It’s getting harder to save for that new home with inflation.

• Pulled in Demand: Contrary to the industry narrative, there was no supply issue in 2020-2021. Those were the best 2 years in total home sales since the GFC topping out at 6.1 million homes sold in 2021 (1M+ more homes sold than in any year between “08 and “19). Low rates, stimulus, forced saving, push to the suburbs and sunshine states, easy access to credit, and stock market meme stocks all helped to push demand up and unleash home sellers with large equity gains on the market. The pulled-in demand, especially in the luxury market is now dragging the market.

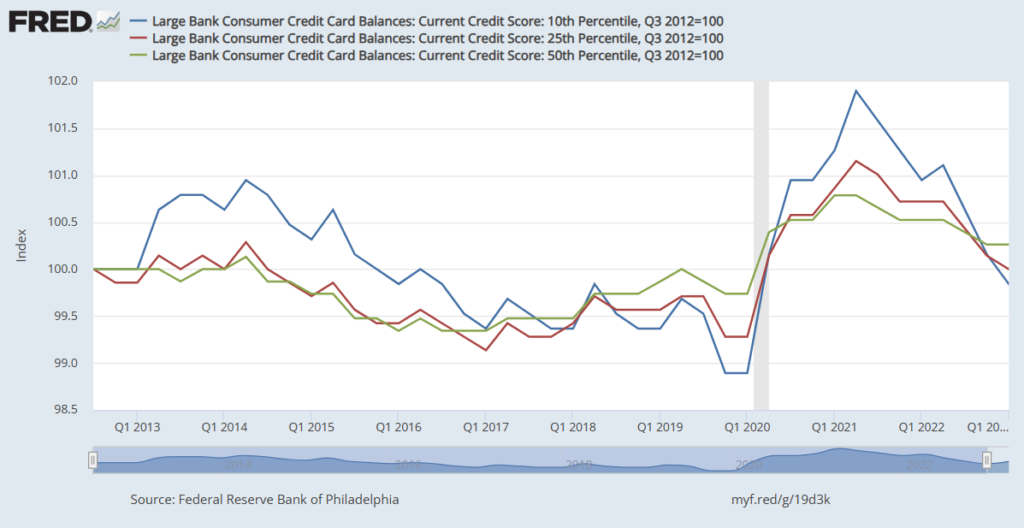

• Rate fallacy/Debt load: Lower interest rates are a reflection of low demand for borrowing. After years of ever-growing record borrowing, households’ appetite for debt is starting to wane. Households are now sitting on a new record of 19.7T in debt. Since 2020, households have added 3.1T in new debt. This is larger than the 2.5T household added between 2012 and 2019. Household debt has grown and now with higher rates the debt load is becoming burdensome. Debt service payments are rising as households pay college debt, credit cards, car loans, personal loans, and other debts. If it wasn’t for a large amount of refinancing of mortgages at ultra-low rates during the pandemic, US households would be drowning.

Rates are only one component.

#fed #federalreserve #rates #yields #dollar #commodities #markets #realestate #realestateadvice #realestate #realestatedata #homebuying #homeselling #homebuying #homeselling #dmvrealestate #marylandrealestate

You the clients and future clients, don’t have to accept it. You don’t have to accept the commission they are offering or the level of services they barely talk about. You have the right to negotiate with real estate agents and their brokers the level of compensation and services as a seller and as a buyer. You deserve more it’s your money, your home, you have the power. You don’t have to:

– Pay broker fees!

– Pay administrative or hidden fees!

– Pay what they say is the commission rate as a seller and a buyer and can negotiate!

– Accept long commitments and have the right to say how and when you can terminate the contract!

– Accept little services and customer service.

– Take on all expenses.

– Accept a few pictures, post them on the MLS, and do an open house and have someone else than them doing it!

You don’t have to accept any of it!

You are the client, you own the home or have the purchasing power, not realtors. You own the power, the asset, the purse, and the process not realtors. You decide not us. You always had the right to set the terms and not set terms set on you. You always had the right to negotiate not be bound by industry standards or policies.

NAR, real estate commissions, and large brokerage house have lost their case in court and have been found to be colluding. Jurors have found that they colluded and awarded 1.78B in damages. We have known this for a long time in the industry and have been saying it. The system was built not as a service-based industry that prides itself on representing the interests of clients but on a middle-man pyramid scheme industry where the few that are on top collect splits, commissions, and fees.

It is time to take back the industry and bring back the clients and the public back into focus, ethics, services, and value. The time is now.

Like JFK said, “I would rather be accused of breaking precedence than breaking my promises.”

My oath is to my clients, their interests, and their success not that of NAR, real estate commissions, large brokerage houses, and developers. My promises are for the first not the latter.

#silversrpingmd #homebuying #homebuyingtips #realestate #dmvrealestate #dmvrealtor #dmvevents #washingtondc #rockvillemd #washingtondc #marylandrealestate #firsttimebuyer #firsttimehomeowner #buyingahome #realestatedata #realestatetips #realestateadvice