Me the last 3 years: “You sure about that?”

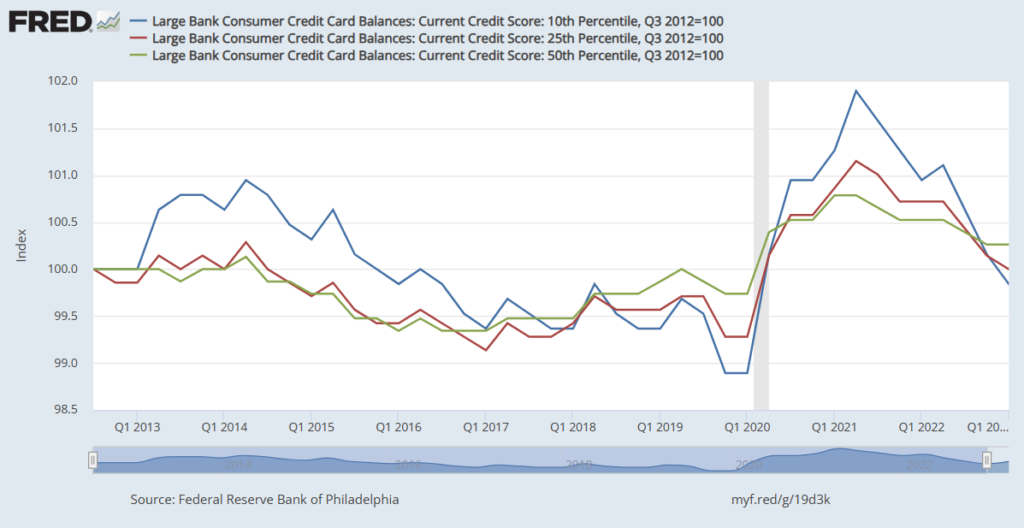

I said several times that the stimulus and forbearance programs were acting as temporary financial safety nets and worse a trampoline for people to borrow more money than they could just like the pre-GFC.

Thanks to Uncle Sam, credit scores shot up like a SpaceX rocket in 2020 and 2021. But, alas, just when you thought the party would never end, the music stopped, and credit card delinquencies decided to crash the party at the end of 2021 and through 2023.

More and more research is coming out looking at the impact of gov intervention on credit scores during the pandemic. When I was saying rising scores with 8 million homeowners in forbearance, millions not paying rent or college debt, and no one getting reported would lead to artificially opening credit and making underwriting mistakes no one listened.

Now we are starting to see that the ones that got the biggest boosts in credit score (deep and subprime) are the ones getting more and more behind in payments. Surprise!

Like Cinderella’s carriage turning back into a pumpkin, their scores are returning to pre-COVID levels. But wait. They got to borrow like a princess to buy the glass slippers from Amazon, the carriage at 120% LTV, and a castle 50k over asking. The banks swore to us they were not lending to subprime like pre-GFC. Yes technically, because much of subprime was magically turned into near and prime with a twist of the wand from the fairy grand federal government mother and got an allowance to build their savings now pretty much gone.

The truth is the banks didn’t care as they had bloated deposits, investors, and the Fed eating up any asset they would through their way. All one had to do was make a loan and securitize it and it would be bought at a premium as soon as it was originated. Sound familiar?

It’s the same story every time. If there is a buck to be made someone will look over details and close their eyes. No one stopped for a second and asked if credit scores, credit history, DTI, savings, and service payments as a percentage of disposable were affected by external forces and no longer were accurate, if long-term/temporary effects, or if standards adjusted to reflect the changes. Nope, let’s lend and lend a low rates and hand out even bigger loans.

They said this time is different. Yes, this time the pig had lipstick on it.

Some of the recent data coming out: